Steel and steel scrap prices are likely to continue to rise sharply in Q2, as demand recovers from the Covid 19, especially in China. Steel suppliers in Asia tend to prefer to sell to the EU and the Middle East rather than to sell in the region.

Hot rolled steel (HRC) and scrap steel prices are likely to continue to rise sharply in Q2, after having risen sharply in Q1, as supply chains gradually restored and commodity markets generally continued their upward trend due to the crisis in Ukraine.

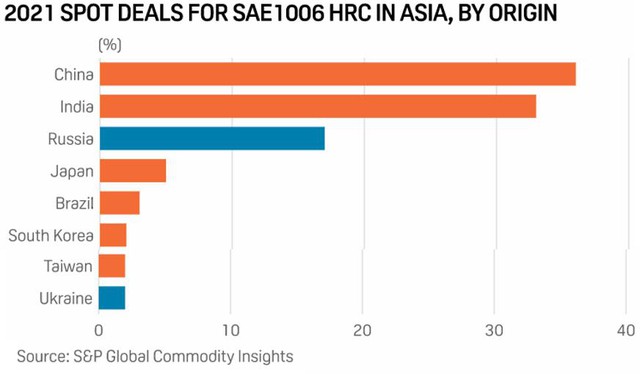

Suppliers in India, Japan, and South Korea have been increasingly focusing on European steel markets since the conflict between Russia and Ukraine, providing opportunities for emerging Chinese factories to become “dominant” suppliers on the Asian market. This trend is likely to continue in Q2 after the EU increased its HRC import quota from India to 62% and from South Korea to 27% as of 1 April.

The flat steel raw material from Russia, Ukraine, India and South Korea is gradually absent on the Asian market, China’s HRC steel can return to the overwhelming position right this second quarter.

S&P Global data shows that India and South Korea accounted for 10% of HRC supply in Asian markets in Q2/2021, which means that their diversion to other markets leaves China with 10% of this market share.

Another reason for China’s HRC steel exports to increase is weak domestic steel demand due to the declining real estate market, which has been increasingly reduced by the fight against Covid-19, along with supply chain disruptions affecting the manufacturing sector.

The difference between China’s HRC export price versus domestic price rose to $52.59 per tonne on March 31, from a negative $17.55 per tonne on January 4, indicating the attractiveness of the export market.

Accordingly, the export price of HRC SS400 increased by 123 USD/ton, or 16%, compared to the same period, far exceeding the increase of 52.43 USD/ton, or 6.5%, of the domestic market.

Despite the blockade by the cities of Tangshan and Shanghai against Covid-19, the impact on steel production in China has so far been limited. It is known that steel production in these two cities has increased steadily since the Winter Olympics, in February 2022.

In addition to the expected increase in exports, China’s HRC steel market outlook is also positive, as domestic demand is expected to increase after the anti- Covid-19 restrictions are relaxed. However, the recovery in both demand and price remains at risk of being affected by supply chain disruptions caused by the conflict between Russia and Ukraine as well as the way China has handled the pandemic.

Falling supply will keep embryo prices high

In the steel workpiece market, there are still concerns about the supply, plus the production costs due to the energy prices will continue to affect the price in Q2/2022. The price of steel workpieces in Tangshan City (China) increased by 13% from the beginning of Q1 to almost the end of the quarter, while the price of CFR steel in Southeast Asia increased by 33% over the same period.

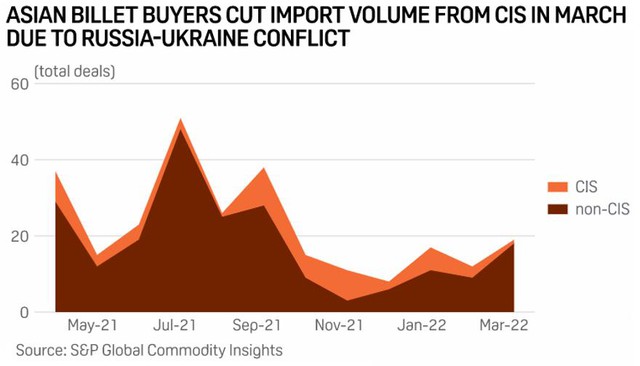

Seeking to avert risks and sanctions associated with buying Russian billet and the shipping risk with Ukraine billet from the Black Sea, Asian buyers had to seek alternatives. This led to the number of observed CIS trades dropping to just one in March from three in February and six in January, spot data compiled by S&P Global showed.

In order to avoid sanctions related to the purchase of Russian steel workpieces and avoid risks during the transport of Ukrainian steel workpieces from the Black Sea, Asian customers had to look for alternative solutions. This led to a decrease in the volume of steel workpiece transactions in SNG in March to just 1 transaction, compared to 3 transactions in February and 6 transactions in January, data from S&P Global shows.

While the domestic steel supply in China in Q1 was cut during the Winter Olympics, the blockades against Covid in some of the country’s cities since then have led to a general decline in the sector’s operations, disrupting logistics. Market participants expect a significant recovery in demand in Q2, should the epidemic improve.

Due to the fact that the Russian-Ukrainian conflict is not yet showing signs of calming down, steel embryos market participants forecast that supply will continue to tighten in Q2, at a time when demand for construction and in the infrastructure sector is recovering throughout Asia.

Reactions from buyers increase as the price of scrap increases

The Asian scrap market is poised to see resistance to price increases in Q2 as steel producers are caught between rising smelting costs and limited downstream product demand.

Scrap market sentiment is expected to continue to decline in Q2 due to volatile freight rates, skyrocketing energy costs and the upcoming rainy season – from late May, which is projected to affect construction steel demand across Asia.

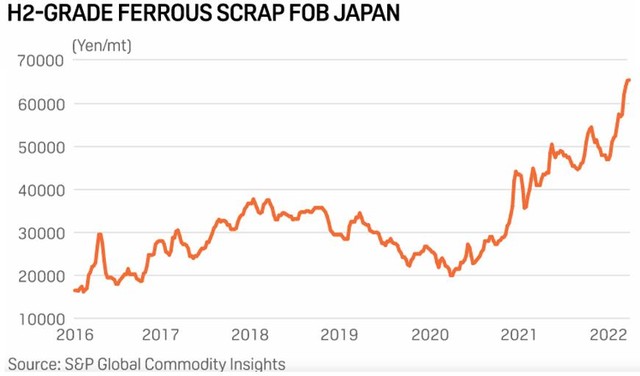

In addition, the resistance from buyers in Q2 will increase after the Japanese scrap price increased 39.3% compared to the previous quarter, with the review of H2 scrap, Japanese fob, rising to 65,500 yen/ton on March 31 from 47,000 yen/ton on December 31, 2021, according to Platts data.

At the beginning of 2022, increased demand for scrap steel caused the price of this material to surge in the Asian market before the conflict between Russia and Ukraine, on February 24, adding further impetus to the rising price of scrap after that event.

The fact that containers carrying scrap originating from the West are late in delivery also increases the regional demand for Japanese raw materials, due to the geographical proximity, so the delivery time is faster.

The weakening of the Japanese Yen against the US dollar in the second half of Q1 as the US switched to monetary tightening policies to curb high inflation made Japanese scrap even more attractive to East Asian customers.

Remarkably, the price of heavy scrap from Japan has risen sharply but is still unusually cheaper than light scrap from the US.

Likewise, scrap prices in the US and Turkey were shaken after the conflict between Russia and Ukraine, as US exporters of raw materials were eventually attracted by high prices from buyers in Asia.

The March 16 HMS 80:20 CFR East Asia (bulk delivery) scrap price reported by Platts at the 14-year high was $665 per tonne, CFR, up 33% from December 31, 2021.

By Nhip song kinh te

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

- #MTAVietnam /

- #MTAVietnam2022 /

- #MTAVN /

- #Steel /

You may be interested in

REPORT ON THE PRODUCTION AND BUSINESS TRENDS OF THE PROCESSING, MANUFACTURING INDUSTRIES IN THE FIRST QUARTER OF 2024 AND FORECAST FOR THE SECOND QUARTER OF 2024

Industrial production in the first two months of the year increased by 5.7% compared to the same period

Việt Nam có thể trở thành ‘con rồng AI’

Vietnam is ready to welcome the wave of investment in smart manufacturing chains.

Humanoid robot converses with OpenAI language AI

Boeing supplier greenlighted to build $20M plant in Vietnam

Vietnam is a potential market for companies engaged in the manufacturing of agricultural machinery and equipment

‘The Giant’ Goertek is expected to invest over 6,800 billion VND in Vietnam to expand production. Which locality will be chosen?