Vietnam’s steel market outlook this year is expected to be better, thanks in part to the promotion of disbursement of public investment capital.

01/04/2022

In the framework of the regular press conference of the Ministry of Industry and Trade, Deputy Minister Do Thang Hai said that advancing the disbursement of public investment capital will also have a positive impact on recovery and growth in some industries such as steel, construction materials, mechanics.

Along with that, the Vietnam Steel Association (VSA) emphasized, the outlook for the steel market in Vietnam in 2022 will be better when the Government issues a directive to stabilize and develop production and business activities flexible adaptation to the COVID-19 pandemic throughout.

Notably, 3 focuses to maintain growth momentum, exploiting the new growth drivers identified by the Government in 2022 include: restoring and promoting production and business; boosting exports and accelerating the disbursement of public investment capital, mobilizing all resources for infrastructure development.

According to VSA, the outlook for the steel market in Q1/2022 may start with a new price front as the price of steel production materials continuously adjusts upwards, with domestic demand having a good signal. In the recently issued Directive 01, the Prime Minister assigned the Ministry of Transport and relevant agencies and localities to further accelerate the investment preparation and investment decision for the North-South east expressway construction project for the period 2021-2025.

Focus on urging to further accelerate the construction progress of the Project on construction of some high-speed road sections on the north-south east route in the period 2017-2020, Long Thanh International Airport Project phase 1.

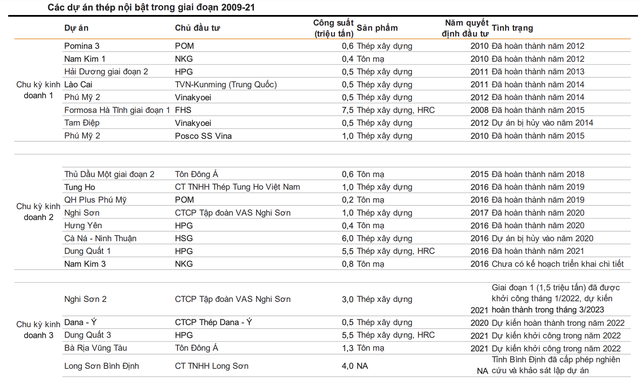

Earlier, VNDIRECT‘s report said that, during the expansion period, high steel demand pulled up the selling price and steel consumption increased sharply. As a result, the gross profit margin of steel mills also increased, attracting many enterprises to boost production or expand the plant.

According to VNDIRECT, Vietnam’s steel industry is having more favorable business conditions than the previous cycle thanks to:

Firstly, the demand for infrastructure investment is huge in Vietnam.

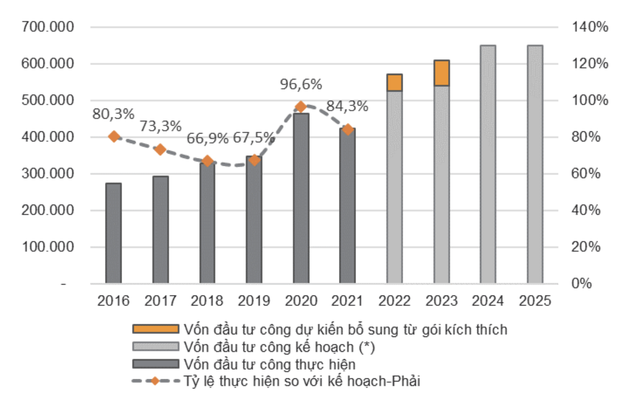

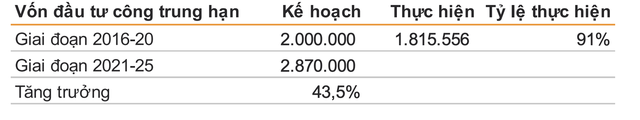

According to the Ministry of Transport, the Government is targeting that the whole country will own 3,000 km of highways by the end of 2025 (from the current 1,163 km of highways). In the medium-term public investment disbursement plan for 2021-25, the estimated capital increase also increased by 43.5% compared to the previous 5-year period.

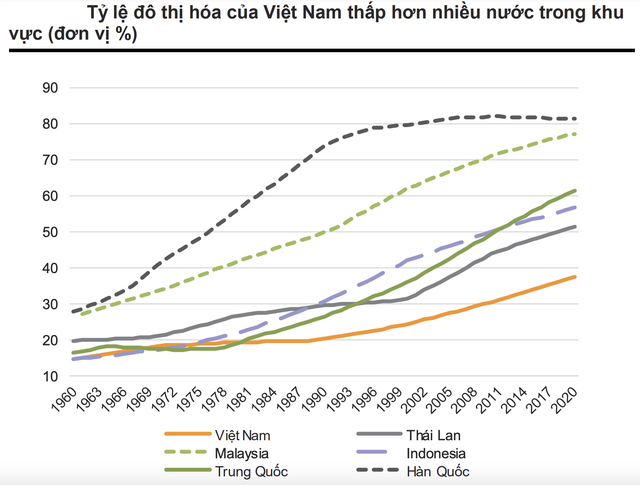

Secondly, the urbanization rate in Vietnam is still low.

The urbanization rate in Vietnam has increased rapidly since 1990 and reached 37% in 2020, but is still lower in many countries in the region.

According to United Nations projections, Vietnam’s urban population will surpass the rural population by 2050. The population displacement to urban areas will follow the increased demand for housing construction, stimulating the demand for steel in civil construction.

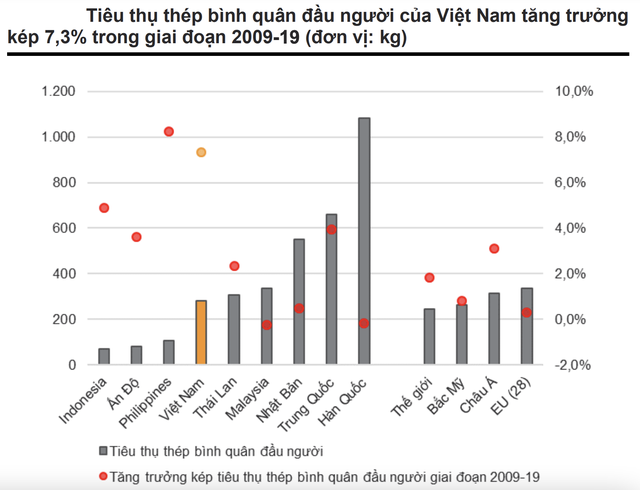

Third, Vietnam’s per capita steel consumption is still below the Asian average.

According to World Steel Association (WSA) data, Vietnam’s per capita steel consumption is 283 kg, higher than the world average of 245kg, but lower than the Asian average of 316kg.

On the other hand, Vietnam’s double growth in per capita steel consumption also set an impressive 7.3% rate in 2009-19, four times/2 times the average growth rate of the world and Asia, respectively.

Finally, Vietnam stands a chance to become the world’s new steel factory.

China, which produces 45% of global crude steel production in 2021, is implementing a series of policies that negatively affect the steel industry such as: eliminating VAT 13% on 146 steel products from May 2021; reducing import duties on crude steel, cast iron and scrap steel to 0% from May 2021; a ban on coal imports from Australia makes it difficult for Chinese steel mills to access cheap raw materials and China is pursuing the goal of reducing CO2 emissions by 65% per unit of GDP compared to 2005 levels, with a focus on reducing the production of heavy industries, including steel.

In addition, the trend of developed countries (US, EU, Japan) increasingly accounts for a low proportion of total steel production. This trend is driven by: developing countries have a high demand for construction, encouraging domestic producers to participate.

Moreover, after a period of heavy industrial development, developed countries will focus on green production, in order to protect the environment, which causes their production costs to rise. Besides, labor costs are also higher than in developing countries.

As a consequence, the competitiveness of the steel industry in the developed world is decreasing. The same thing is happening in China, where the per capita income of the country’s workers has increased tenfold since 2000, according to World Bank. Therefore, this will open up development opportunities for the steel industry of developing countries with low labor costs, including Vietnam.

Vietnamese steel producers increased their exports sharply in 2021, largely thanks to strong demand from key export markets such as China (for long steel), the EU and North American countries (for flat steel).

In the future, potentially deficient export supply due to developments related to China and cheap labor cost advantages will create very good opportunities for Vietnamese steel producers to enhance their position in the global market.

By Business and Marketing

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

Impressions Of The Conference “3D Metal Printing: From Potential To Application Reality For Professional Manufacturing In Vietnam”

Discover The Seminar “Digital Transformation: Reducing Technology Waste”

Experience At Talkshow “World Class Manufacturing: How To Get There From Here”

Inside The Seminar “Promoting Vietnam’s Production Transformation Towards Smart Production”

Looking Back At Talkshow “How To Improve Business Collaboration And Funding Capacity For Manufacturing Firm”

Talkshow “World Class Manufacturing: How To Get There From Here”

Conference “Accelerating Vietnam’s Manufacturing Transformation Towards Smart Production”

Talkshow “How To Improve Business Collaboration And Funding Capacity For Manufacturing Firm”