When does Vietnam have cheap cars?

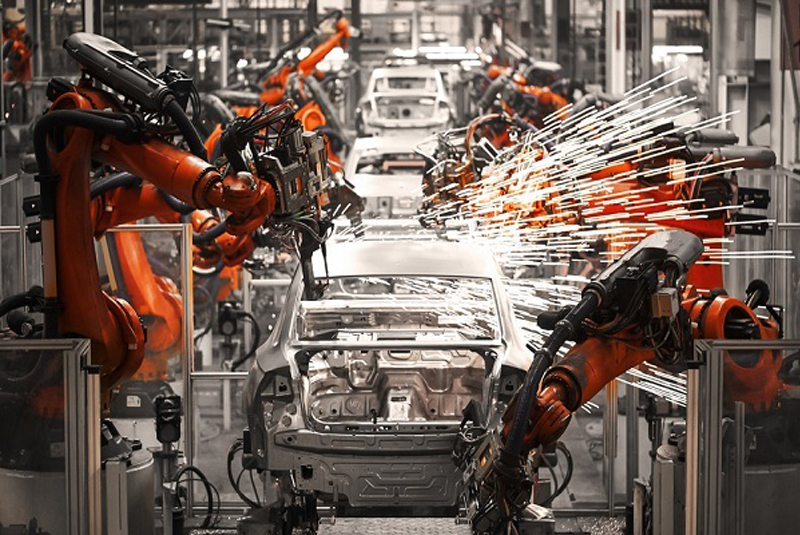

31/03/2022In 2022, domestic automobile manufacturing enterprises are expected to solve the localization problem soon to reduce the cost of domestic automobile production and assembly.

The price of a car is difficult to cheap

Vietnam is gradually moving towards the goal of vaccine coverage, controlling the Covid-19 epidemic, automobile business is forecast to be more stable. Along with that, Decree 103/2021/ND-CP issued by the Government, effective from December 1, 2021, to May 31, 2022, reduced registration fees for cars assembled and produced domestically, creating more incentives for people to buy cars.

According to industry experts, the Government’s agreement to reduce registration fees by 50% over a period of 6 months for domestically assembled vehicles will be a major incentive to boost domestic automobile assembly production, limit imported cars and stimulate consumer demand for shopping due to the negative impact of Covid-19.

Specifically, in the first two months of 2022, 53,544 vehicles were sold to the whole market. Although there are hundreds of thousands of cars per year and it continues to be assessed that car sales will be buoyant this year, it is undeniable that the price of cars in Vietnam is still higher than in other countries.

One of the reasons why domestic car prices are still higher than in other countries is due to tax and fee policies. Even taxes and fees now account for much of the real value of many cars before they are wheeled in the market.

Many experts also commented objectively, despite the recent fall in the price of automobiles in Vietnam, it is still nearly two times higher than in other countries in the region such as Thailand and Indonesia. This figure is even greater if compared to countries with a steadily growing automobile industry such as the United States and Japan. This is mainly due to high taxes and fees for domestically produced cars.

Remove localized “bottlenecks”

Not only is it burdened with taxes and fees, but the automobile industry in Vietnam is also considered undeveloped due to the low rate of localization. Currently, the domestic automotive market has a lot of different models. In terms of models only, of the more than 100 vehicles being manufactured and assembled in Vietnam, no model has achieved a production of 50,000 vehicles per year, while this is the minimum to increase the domestication rate of the sector.

Looking at the domestic automobile market, the Department of Industry (Ministry of Industry and Trade) points out that the size of the Vietnamese automobile market is too small, the lowest of the 5 countries with automobile industry in ASEAN, equal to 1/3 the size of Thailand’s automobile market, 1/4 of Indonesia’s… That makes it difficult for the industry to increase the localization rate to cut production costs, reduce product costs.

Some car manufacturing enterprises said that the cost of producing cars in Vietnam is 10-20% higher than the price of similar cars produced in Thailand, so this is what domestic car manufacturing enterprises consider how to invest in efficiency between the import of vehicles or assembly production.

To encourage localization, representatives of the Vietnam Association of Supportive Industries (VASI) said that tax policy is important and suggested that tax policy should be long-term stable to encourage automobile enterprises to develop well-developed investment strategies, otherwise domestic component manufacturers only dare to invest in a “vegetarian” style.

The Industrial Bureau also specified that more than 90% of enterprises supplying automotive components in Vietnam are FDI enterprises. Only a few domestic enterprises participate in the supply network for automobile production and assembly but account for a small share. Whereas, to make a finished automobile, it takes between 30,000 – 40,000 details, parts.

Since the company has not actively produced components and also has no really large enterprises in the automotive industry, the import of components certainly increases the cost of production and assembly of cars in the country.

According to economic experts, the Vietnamese automotive industry in 2022 can see the “bright door” from the prospects of manufacturing and supplying original components and equipment (OEM) to major partners globally. Applications such as Truong Hai Automobile Joint Stock Company (Thaco) – a domestic automobile company that can export auto parts and accessories, the production and supply of OEMs to major partners is the way for Thaco to deeply participate in the world’s value chain. This helps the company to understand the requirements, production process and quality control of OEM components according to global standards, based on which to develop a roadmap to localize quality components in accordance with the standards of the car manufacturers.

According to VASI, out of 350 automobile-related manufacturing enterprises in Vietnam today, up to 214 manufacturing enterprises produce automotive components and spare parts… However, it is not simple for these businesses to become OEM suppliers.

If the Vietnamese automotive industry is to have more OEM suppliers for large global partners, experts say, enterprises of the domestic block need to continue to restructure the network at the production level and improve the value chain. This requires building the capacity and readiness of enterprises in terms of thinking, technology, human resources, infrastructure, etc.

Besides, with a car that needs from 30,000 to 40,000 different details and components, the Vietnamese automobile industry must have close cooperation with many other industries such as mechanical engineering, electronics, chemical industry… to bring more efficiency than currently.

Automobile enterprises also proposed to consider adding automotive products to the list of high technology, encouraging production, thereby helping enterprises to promote investment, expand production, increase the localization rate, develop Vietnamese automotive products.

Source: Cong thuong

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

Impressions Of The Conference “3D Metal Printing: From Potential To Application Reality For Professional Manufacturing In Vietnam”

Discover The Seminar “Digital Transformation: Reducing Technology Waste”

Experience At Talkshow “World Class Manufacturing: How To Get There From Here”

Inside The Seminar “Promoting Vietnam’s Production Transformation Towards Smart Production”

Looking Back At Talkshow “How To Improve Business Collaboration And Funding Capacity For Manufacturing Firm”

Talkshow “World Class Manufacturing: How To Get There From Here”

Conference “Accelerating Vietnam’s Manufacturing Transformation Towards Smart Production”

Talkshow “How To Improve Business Collaboration And Funding Capacity For Manufacturing Firm”