Russian steel exports head for Asia as sanctions rise

24/03/2022International analysts say Russia’s hot rolled steel (HRC) may appear on the Asian spot market after a 4-5 month period due to widening economic sanctions against Russia, while Russian exports of steel workpieces may divert to China if the country does not deal with traditional customers.

Since Russia accounts for about 10% of global steel trade, and Ukraine for about 4%, supply disruptions from the region are causing concern to disturb the world steel market.

On February 26, a joint statement on Russia’s exclusion from swift (Global Association of Interbank Financial Telecommunications) was unanimously signed by the US, the European Commission, France, Germany, Italy, the UK and Canada, seriously affecting the Russian economy while also having a significant impact on the world economy, including those economies that make this decision.

The list of banks has not yet been finalized, but the US and the EU have introduced sanctions against Russia’s major banks – which account for 80% of its financial transactions.

Russia was not the first country to be eliminated from SWIFT. The West has removed Iranian banks and the DPRK from the system after being punished by the EU for its nuclear program. It is known that Iran lost nearly half of its oil export revenue and 30% of its international trade value after the move. It was not until 2017 that Iran was allowed to use swift again when the West lifted the embargo.

According to Sputnik, about 300 leading Russian banks and institutions are using swift, more than half of Russian credit institutions are represented in swift and Russia is ranked second in the number of users of the platform, just after the US. The observers said that this sanctions could devastate the Russian economy and market, severely affecting the ruble.

Chinese steel exporters recently said they are concerned steel prices will rise, predicting exports from Russia will fall as their banks are removed from Swift. Russia’s reduced exports are expected to lead to tensions in global steel supply and increase the price and volume of China’s steel exports. Argusmedia quoted a Chinese exporter as saying that, for the time being, Russia does not offer immediate delivery and no one would consider buying from Russia. Another businessman in eastern China said sanctions on Russia’s Swift access would increase commodity price inflation, including in the steel sector.

HCR steel price in May on the Shanghai Forward Exchange session 4/3 at 5,210 CNY/ton, increased by nearly 6% compared to session 27/2 and reached its highest level since October 2021; construction steel also increased to 5,100 CNY/ton, while stainless steel reached 18,775 CNY/ton.

The disruption of steel exports from Russia and Ukraine has pushed customers to alternative sources, especially China, the world’s largest steel producer.

“Some Russian banks have been sanctioned, but that is not a problem, as we can turn to other banks for business. If Russia is punished for financial payments using the US dollar, the Iranian way, then exports will fall dramatically, ”the trader based in eastern China said.

Russia has not sold much steel to Asia in the past months due to the unattractive prices of exports to the region compared to domestic and regional ground. Its steel exports to Hong Kong fell to 55,000 tonnes last year after rising to 220,000 tonnes in 2020. There were no sales of steel plants from Russia to Singapore last year.

International analysts commented that increased steel production at Vietnam’s Hoa Phat plant, which began supplying steel plants to Hong Kong and Singapore last year, was a factor that could support the Asian market in the face of any immediate Russian supply disruption. But changes to trade flows are possible.

Hoa Phat produced 707,000 tons of crude steel in January 2022, an increase of 5% year-on-year. The January company said its consumption reached 631,000 tons, of which construction steel accounted for 382,000 tons, double the same period in 2020.

Russian steel supplies account for a small share of HRC trade in Asia. Russia sells about 30,000 tons of HRC steel to Vietnam every month. Russian steel exports to Vietnam have been limited in volume since October 2021 because Vietnam has sufficient domestic and regional supply to meet its needs.

Vietnam’s iron and steel imports from Russia in January 2022 were 117,549 tons, valued at USD 96 million, a volume increase of nearly 70% compared to December 2021 but a decrease of 8% compared to the same month last year, putting Russia in 5th place among iron and steel suppliers to Vietnam, accounting for 11.5% in volume.

But a decline in Russian HRC exports to Europe and the US could lead to many Indian steel exporters leaving the Asian region to divert sales to customers in those regions.

Russia exported 13 million tonnes of semi-finished steel in 2020, with China accounting for 6.7% of all Russian steel exports. In 2021, China accounted for 5% of Russia’s total of 14.9 million tonnes of semi-finished steel exported. China’s share of steel embryos exports, the majority of which is semi-finished steel that it imports from Russia, may increase due to increased sanctions against Russia.

It is currently unclear whether Asian steel market participants, including in China, are willing to trade with Russian banks or trade Russian commodities. Coke buyers in China last week raised concerns about Russian coal purchases amid uncertain trade finances. They expressed such hesitation despite China’s growing reliance on Russian coal, following the country’s refusal to import Australian refined coke in 2020 due to political tensions with the country.

Operation on the Black Sea iron and steel market has almost stopped since the end of February due to production restrictions by the Ukrainian steel embryos producers, when the main ports ceased operations. Customers also hesitate to trade with Russian factories because of uncertainty about what the upcoming sanctions will look like, in which some turn to Turkish suppliers.

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

Optimize operations in the context of epidemics and market volatility

Expectations for the development of supporting industries in Ho Chi Minh City. Ho Chi Minh

Complete Hybrid Cloud Connectivity Solutions for the Enterprise

Russian steel exports head for Asia as sanctions rise

Vietnam continues to be an attractive destination for US investors

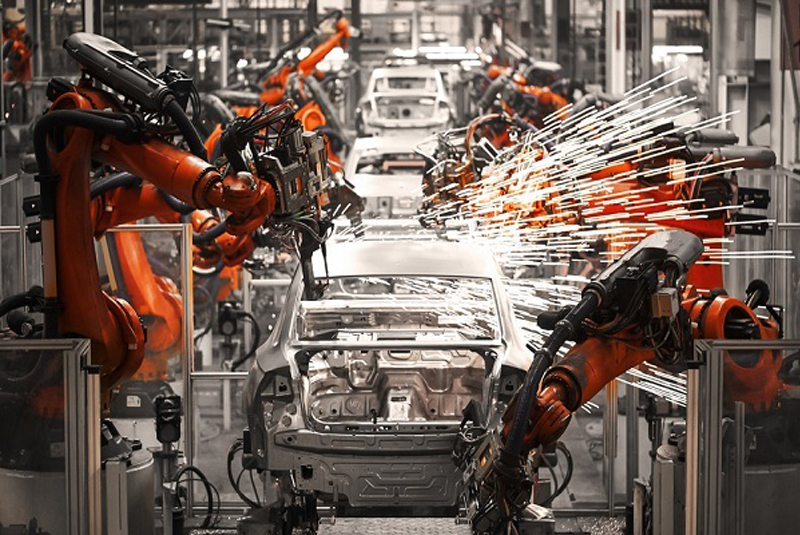

Ukraine War Plunges Auto Makers Into New Supply-Chain Crisis