For German Firms, Ties to Russia Are Personal, Not Just Financial

10/03/2022The economic fallout from Russia’s invasion of Ukraine is only part of the pain for German companies.

When Peter Fenkl heard that Russia had invaded Ukraine, he said his first thoughts were not for the business his German company stood to lose in either country, but for the fates of his employees in the region, who over years of business dealings and shared drinks had become more than just colleagues.

“These are more than just business relationships, they are real friendships,” said Mr. Fenkl, the chief executive of the company, a maker of industrial fans. “We have sat next to each other in meetings, had beers together.”

The family-owned company, Ziehl-Abegg, has 4,300 employees, and Mr. Fenkl recalled how the teams from Germany, Russia and Ukraine worked side-by-side, on business trips and during trade fairs where Ziehl-Abegg would display its wares.

Now all four of the company’s employees in Ukraine have taken up arms to defend their country. In Russia, where the company has a production facility and employs 30 people, business has ground to a halt.

Mr. Fenkl said he had spoken several times with his company’s manager in Russia in the past week, trying to figure out how to proceed as the gravity of the situation became clearer.

“Twice I called the colleague in Russia and he couldn’t talk,” Mr. Fenkl added. “He kept breaking down in tears.”

German companies do far more business in Russia than any other European Union country does, exporting goods worth more than 26 billion euros ($28.4 billion) last year (Poland was second with €8 billion) and investing a further €25 billion in operations there. This commitment to the Russian economy reflects, in part, an ethos embraced by the former West Germany coming out of World War II — that trade could ensure peace and prevent Europe from descending into another war.

Russia’s annexation of Crimea in 2014, and the sanctions that followed, caused the number of German firms investing in Russia to drop by a third. Still, the figure was just under 4,000 companies by 2020, with many convinced that their presence could help anchor Russia in the democratic sphere.

On Feb. 24, that belief was shattered, leaving companies of all sizes wondering what to do next.

While some have announced decisions to pull out and have started unwinding business ties, others are trying to stay on, some out of loyalty to their employees, despite Western sanctions that have thrown up huge obstacles to banking and cross-border transport, and the collapse of the ruble. What remains for many businesses is a profound sense of sadness, coupled with disillusionment.

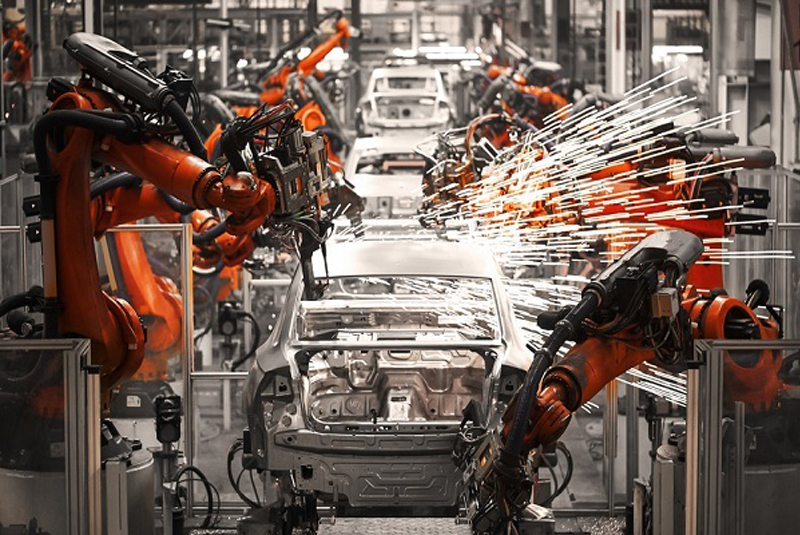

Germany’s leading automakers — BMW, Volkswagen, Mercedes-Benz and Daimler Truck — all announced last week that they were halting their exports and production in Russia. Family-owned firms, including ZF Group, a car parts maker, and Haniel, which manages several independent businesses in the country, are doing the same.

“While our options are limited, we still can have an impact,” Thomas Schmidt, chief executive of Haniel, said in a video statement, announcing that all business activities in Russia and Belarus would be halted and commitments unwound. “I understand it is tough from a customer and supplier relationship perspective, but it is more important that we get people on the street protesting.”

That sentiment is even coming from the German Eastern Business Association, a group of companies that for decades has been a cheerleader for deeper economic ties with Moscow, even in the face of the increasingly anti-democratic moves by President Vladimir V. Putin. The group is celebrating its 70th anniversary this year, and several of its members were previously scheduled to meet last week with the Russian president in Moscow. The trip was abandoned after the invasion.

“We should call a spade a spade: It is currently less about the sanctions and their consequences than about the question of whether or not we will still have significant economic relations with Russia in the future,” said Oliver Hermes, chairman of the business organization. In 2014, the group had campaigned against severe economic punishment for Moscow, but this time is different.

“The sooner the Russian government stops this war, the more of these relations can still be saved,” Mr. Hermes said. “There is no question that the German economy will support the sanctions imposed.”

Years ago Martin Daller, the chief executive of Seebacher, a maker of specialty lighting controls, hadn’t been interested in investing in Russia. But it is an enormous, attractive market for the products developed by his family-owned company, based in Bad-Tölz, and when a Russian manager quit a rival company and approached him about setting up a Russian division, he decided to give it a try.

That was just before the outbreak of the coronavirus pandemic, but business was starting to pick up this year. Then came the invasion.

“Now, we are wondering what we should do. Break off contact and just let him go,” said Mr. Daller, whose company has annual revenue of €2.5 million. “From a financial point of view, it wouldn’t be that dramatic for us. But he is a father of three and the whole family depends on his job.”

It is not only the smaller companies that are facing tough decisions.

Wintershall Dea, a German oil and gas company with a global portfolio of projects, canceled its annual company news conference that was to be held on Feb. 25, the day after the invasion. Instead, its leaders issued a joint statement on March 2 expressing alarm at the war.

“We have been working in Russia for over 30 years. Many of our colleagues at our other locations also work with partners from Russia on a daily basis,” it read. “We have built many personal relationships — including in our joint ventures with Gazprom,” Russia’s state energy giant.

“But the Russian war of aggression against Ukraine marks a turning point,” they said. “What is happening now is shaking the very foundations of our cooperation.”

The company separately said that it would stop payments to Russia and write off its €1 billion investment in the ill-fated Nord Stream 2 natural gas pipeline linking Russia and Germany, that the government in Berlin had suspended on Feb. 22. It will also not receive any revenue from its oil and gas operations in Russia, which accounted for nearly a fifth of its operating profit in 2021.

Not every German company is pulling out. Metro, a wholesale food company with 93 locations in Russia, where it had revenue of €2.4 billion last year, said that it had decided to continue operations out of concern that pulling out would disrupt food supplies to the population. “None of our 10,000 employees in Russia is personally responsible for the war in Ukraine,” the company said in a statement.

Metro said it was also trying to operate some of its 26 stores in Ukraine, depending on the security situation, and was supporting efforts to provide for people who were forced to flee their homes.

Beyond the impact to companies that had invested in Russia, analysts are predicting that the broader German economy will be hurt by increases in prices for energy and food as a result of the war. Since the invasion, politicians have been rallying the public to view their sacrifices through a wider lens.

“My country, Germany, will be the country that will bear the brunt of the sanctions that have been adopted by the European Union and by the U.S.,” Emily Haber, Germany’s ambassador to the United States, said on Twitter. “We are prepared to carry the burden. Freedom is priceless.”

Source: The New York Times

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

REPORT ON THE PRODUCTION AND BUSINESS TRENDS OF THE PROCESSING, MANUFACTURING INDUSTRIES IN THE FIRST QUARTER OF 2024 AND FORECAST FOR THE SECOND QUARTER OF 2024

Industrial production in the first two months of the year increased by 5.7% compared to the same period

Việt Nam có thể trở thành ‘con rồng AI’

Vietnam is ready to welcome the wave of investment in smart manufacturing chains.

Humanoid robot converses with OpenAI language AI

Boeing supplier greenlighted to build $20M plant in Vietnam

Vietnam is a potential market for companies engaged in the manufacturing of agricultural machinery and equipment

‘The Giant’ Goertek is expected to invest over 6,800 billion VND in Vietnam to expand production. Which locality will be chosen?