STEEL INDUSTRY OVER THE MONTH OF COVID

21/05/2021Steel production and consumption in January decreased slightly compared to the peak at the end of last year but increased by 55-60% over the same period.

The Vietnam Steel Association (VSA) said that efforts to control the third wave of the epidemic and the implementation of free trade agreements helped the steel industry suffer not too negatively in the first month of this year.

Production output in this period reached 2.65 million tons, up 60% over the same period last year. More than 2.11 million tons of steel of all kinds were sold to the market, down nearly 13% compared to the last month of 2020 but increased by one and a half times over the same period. In which, export output reached more than 457,000 tons and increased by 6%.

Hoa Sen Group led the steel pipe market share with 22.75% when consuming nearly 40,360 tons, nearly equal to the total output of enterprises not in the top 5 combined. Only about 350 tons less, Hoa Phat Group ranked second with a market share of 22.56%. The remaining enterprises in this list are Nam Kim 10.85%, Minh Ngoc 8.49% and TVP 8.21%.

Hoa Sen also leads the market share of metal-plated and color-coated corrugated iron with 37.5%, followed by Ton Dong A, Nam Kim and Hoa Phat. The management board of this business said that the export volume of galvanized steel sheet recently set a new record of over 121,000 tons, bringing in revenue of over 100 million USD a month.

In the construction steel segment, Hoa Phat leads the market share of 27.8% when producing more than 308,000 tons and consuming over 186,000 tons. Sales volume decreased sharply compared to the last month of the year, but still maintained a positive growth of 6% over the same period. The company ranks first in sales volume in the North, South, and export, while Formosa Ha Tinh leads in the Central region.

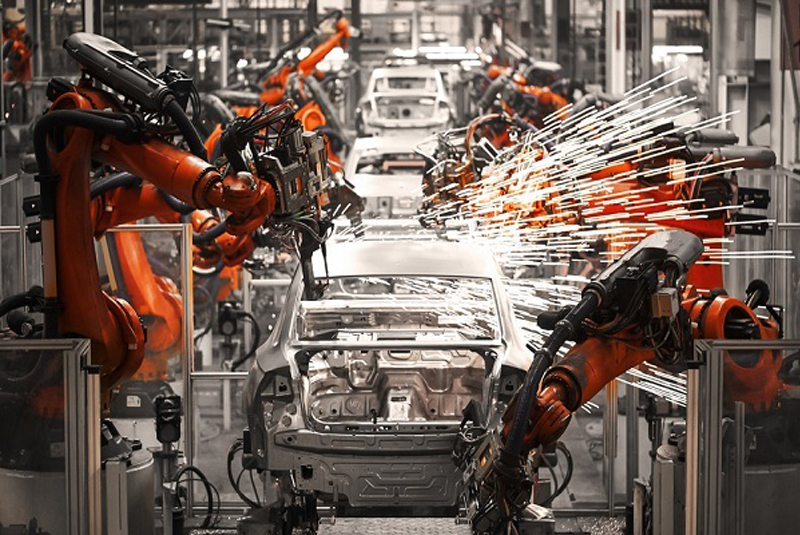

Workers at Hoa Sen steel factory. Photo: Thuy Dung.

According to the analysis team of Rong Viet Securities Company (VDSC), the steel industry is entering a series of great internal fluctuations. Construction demand fell, but some businesses still grew by finding new markets or gaining market share from weaker competitors.

The game in the flat steel segment will change dramatically as domestic mills improve their production capacity to meet most of the domestic hot-rolled steel demand. This leads to an increased opportunity for Vietnamese steel to export when the origin is not China.

With the long steel segment, the market share of companies using blast furnaces will continuously improve as profit margins are less dependent on material price movements and economies of scale.

However, VDSC experts said that the risk the steel industry may face in the short term is the speed of disbursement of public investment projects and real estate that is blocked due to the epidemic. Besides, fluctuations in raw material prices and the stagnation in the exchange of imported goods also pose a potential threat to the growth plans of steel enterprises.

Must Read

2023 PARTICIPANT LIST

[Seminar] INDUSTRIAL METROLOGY

MTA Vietnam 2022 Webinar

ADB is optimistic about Vietnam’s economy

MTA Vietnam 2021 x Bystronic Webinar

CONFERENCE SERIES

ONLINE BUSINESS MATCHING PROGRAMMES

You may be interested in

REPORT ON THE PRODUCTION AND BUSINESS TRENDS OF THE PROCESSING, MANUFACTURING INDUSTRIES IN THE FIRST QUARTER OF 2024 AND FORECAST FOR THE SECOND QUARTER OF 2024

Industrial production in the first two months of the year increased by 5.7% compared to the same period

Việt Nam có thể trở thành ‘con rồng AI’

Vietnam is ready to welcome the wave of investment in smart manufacturing chains.

Humanoid robot converses with OpenAI language AI

Boeing supplier greenlighted to build $20M plant in Vietnam

Vietnam is a potential market for companies engaged in the manufacturing of agricultural machinery and equipment

‘The Giant’ Goertek is expected to invest over 6,800 billion VND in Vietnam to expand production. Which locality will be chosen?